What's Going on in the Markets March 30, 2025

Monday, March 31, 2025 at 8:46AM

Monday, March 31, 2025 at 8:46AM Consumers continued to sour on the economy in a week when the only components heading north were market volatility, precious metals, and energy prices. The stock market struggled to sustain positive momentum early in the week following its sharp drop into correction territory (1) earlier this month.

For the week, the S&P 500 index lost 1.5%, the tech-heavy NASDAQ slid 2.6%, and the small caps shrunk almost 2%. Even bonds of every kind showed weakness, which is uncharacteristic of a weak stock market, where treasury bonds tend to see an inflow of capital to “safety.” Institutions continued to press the sell button in a re-acceleration of distribution (2).

CONSUMERS LOSING CONFIDENCE

Economic news didn’t help things much last week.

New Home Sales from the U.S. Census Bureau rose marginally. However, the inventory of unsold new homes also increased to 500,000, the highest level on record outside the last housing bubble. Worse yet, most new homes for sale are still under construction, while only a quarter of the unsold new homes are completed.

This is a concerning sign for homebuilders that the inventory glut will likely continue to grow, and elevated inventory often precedes housing market slowdowns and economic downturns.

Pending Home Sales for Existing Homes from the National Association of Realtors also ticked up slightly, though they remain near the lowest level in the series' history.

A confident consumer is a consumer who is willing to spend money, and spending money keeps the economy strong and helps to create new jobs.

Unfortunately, Consumer Confidence tumbled to 92.9, falling below its 2022 low. Most concerningly, the most significant drop was in the leading Future Expectations Index, which plummeted to 65.2, its lowest since 2013 and well below the Conference Board’s Recession Warning Threshold of 80.

The final reading for March’s Consumer Sentiment confirmed the crumbling of consumer attitudes, also declining more than expected. The Overall Index dropped to 57, its lowest level since 2022. It also showed the greatest weakness in the leading Future Expectations Index, which fell 11.4 points to 52.6 in its most significant single-month drop since August 2022.

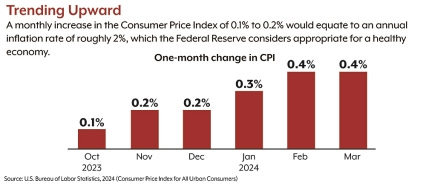

A leading reason for the sharp reversal in consumer psychology is a concern over reheating inflationary pressures. Consumer Sentiment Inflation Expectations for the year ahead jumped from 4.3% to 5%, logging a third month of significant increases of 0.5 percentage points or more.

These inflation fears were validated on Friday as the Federal Reserve’s preferred inflation measure exceeded expectations. The Core Personal Consumption Expenditures (PCE) Price Index rose to 2.8% following an upwardly revised reading last month. This remains stubbornly above the Fed’s 2% target, indicating a reheating of inflation pressures and further complicating the Fed’s battle.

The administration’s trade and tariff battles will not help with inflation, which also weighs on the minds of consumers and businesses of every size.

GOOD RIDDANCE 1ST QUARTER OF 2025

With one trading day remaining in the first quarter of 2025 (Monday, March 31), besides a robust rally in precious metals and overseas markets, there’s not much to celebrate in U.S. Stocks.

After a solid 2024 (and not counting Monday’s trading activity), the S&P 500 index is on track to shed 5.1%, the NASDAQ will slide 10.3%, and the small caps will show losses of 9.6% for the first quarter of 2025. It’s not the start to the year that most were expecting with the optimism in the new incoming administration.

Energy and healthcare are the two strongest sectors year-to-date (up 8% and 5%, respectively), while technology and consumer discretionary, two of the largest sectors, are the weakest (down 12% and 11%, respectively).

In a sharp reversal from 2024, the United States is one of only six major global markets down year-to-date. Twenty-two global markets look to show gains, with ten up double-digit percentages year-to-date (Spain, Italy, and China are the best, while the United States, Taiwan, and Turkey are the worst).

Diversification outside the United States (and, for that matter, outside of domestic big cap technology) over the past couple of years has been a headwind, but it has now turned into a tailwind.

IS THERE ANY GOOD NEWS?

The good news is that we are entering the month of April, which tends to have market tailwinds at its back and is one of the most frequently positive months of the year (especially when January is positive, which it was). We also have signs of oversold conditions, but not overly so. But first, we must see the market show signs of stabilization and a let-up in the selling.

So far, what bounces have come along have been sold as investors sell first and ask questions later ahead of the April 2 “Liberation Day,” when many new tariffs are expected to take effect.

On a positive front, some think April 2nd will be a “buy the news” event after “selling the rumor.” Indeed, we should have more clarity after that date than now, and markets often celebrate less uncertainty.

The President’s announcement last week of 25% tariffs on all imported cars certainly didn’t help consumer sentiment or inflation expectations. But it did create a rush to car dealerships this weekend, where I imagine scenes akin to Black Friday sales to get ahead of the tariff deadline. That’s one way to pull forward car demand into a busy (springtime) month and quarter end. I don’t think these tariffs are going away.

If you’re in the market to sell your used vehicle, waiting a week or two could yield a higher selling price. On the other hand, if you’re in the market for a used vehicle, you may want to speed up that process because used car prices will likely move upward as new auto tariffs go into effect.

It’s widely cited among investing professionals that the bond market is smarter than the stock market. And if there are genuine recession or growth fears, corporate bonds certainly aren’t showing them, at least not yet.

One measure of bond sensitivity to economic conditions is the yield spread between the lowest-rated investment-grade bonds (AKA Incremental BBB-rated US corporate bonds) and yields on the Investment-Grade aggregate index. That differential is still quite low at 23 basis points (3). So, while stocks show signs of a growth scare, the corporate credit market does not, and that’s a positive for the markets overall.

SO WHAT SHOULD I DO NOW?

It’s often said that Wall Street is the only place on the planet where they throw a sale, and people run the other way. Not only that, but they line up at the return desk, toss their undesired merchandise at the clerk, and are willing to accept much less than they paid for the same merchandise still in its original packaging. Yes, I’m talking about stocks.

If you consider yourself a long-term investor and are not taking at least a slight advantage of the (10%-30% off) sale on Wall Street, then are you a real investor? Many of the market’s hottest stocks are selling for 10%-30% off. Will you regret not buying some of them when you look back 12-18 months from now, especially if April 2nd turns out to be the bottom?

Sure, the markets can go lower, and they will probably do so in the short term. But in six months or more, will you remember why you even thought of shedding most of your portfolio or couldn’t pull the trigger on some new buys? And if you look smart selling today and the market goes lower, when will you know it’s safe to return? Trust me; it’s a lot harder than it sounds.

We’ve been buying stocks and doing additional light hedging for our client portfolios. It’s not easy, but sometimes you have to hold your nose, close your eyes, and buy something good.

TURN OFF THE BOOB TUBE OR THE IDIOT BOX

If you’re watching or listening to the carnival barkers on financial media, they will try to scare you witless.

When you tune into the weather channel, are they interviewing people basking in the Hawaiian sunshine, smiling and sipping on a Mai Tai? Or are they looking at the worst weather disaster in the nation and making you feel like your region is next to get hit, only to try and keep you glued to your seat?

That’s right. Sounding pessimistic, forecasting market crashes, predicting a currency crisis, or warning of a deep financial depression ahead might keep you tuned in endlessly, but all it will get you is depressed and won’t make you a dime.

Besides, if things were ever as bad as they make them sound, do you care if your portfolio heads down another 5%-10% in the short term if you zoom out 6-18 months on any long-term index chart?

I don’t. And neither should you.

Disclaimer: None of the foregoing is a recommendation to buy or sell securities. Please consult with your financial advisor before taking any action.

(1) A correction is a pullback in a stock market index closing 10% or more below its all-time high.

(2) Distribution refers to selling or transferring large quantities of stocks or other securities by institutional investors, such as mutual funds, hedge funds, or pension funds.

(3) A basis point is 1/100th of a percent. One percent, therefore, equals 100 basis points.

Sam H. Fawaz is the President of YDream Financial Services, Inc., a fee-only investment advisory and financial planning firm serving the entire United States. If you would like to review your current investment portfolio or discuss any other tax or financial planning matters, please don’t hesitate to contact us or visit our website at http://www.ydfs.com. We are a fiduciary financial planning firm that always puts your interests first, with no products to sell. If you are not a client, an initial consultation is complimentary, and there is never any pressure or hidden sales pitch. We start with a specific assessment of your personal situation. There is no rush and no cookie-cutter approach. Each client and their financial plan and investment objectives are different.

Sources: InvesTech Research and The Kirk Report