So President-elect Trump didn't crash the market; the world didn't fall apart after the Brexit vote; and the worst start to the year in history didn't derail what ended up being a pretty good year in the stock markets. "Who da thunk it?"

You know you’re deep into a longstanding bull market when you see things like average pedestrians keeping one eye on the market tickers outside of brokerage houses to see when the Dow Jones Industrial Average has finally breached the 20,000 mark. Who would have imagined record market highs at this point last year, when the indices ended the year in slightly negative territory? Or when the new year 2016 got off to such a rocky start, tumbling 10% in the first two weeks—the worst start to a year since 1930?

The markets eventually bottomed in mid-February and began a long, slow recovery, turning positive by the end of March, suffering a setback when the U.K. decided to leave the Eurozone, and endured another hard bump right after the elections. In the end, we were disappointed; the Dow finished at 19,762.60 for the year—but the bull market has continued for another year.

This was the second year in a row that the final quarter provided investors with solid gains. The Wilshire 5000--the broadest measure of U.S. stocks—was up 4.54% in the fourth quarter of 2016, ending the year up 13.37%. The comparable Russell 3000 index gained 4.21% in the final quarter, to finish up 12.74% for the year.

Large cap stocks were up as well. The Wilshire U.S. Large Cap index gained 4.14% in the fourth quarter, and finished the year up 12.49%. The Russell 1000 large-cap index closed with a 3.83% fourth quarter performance, and finished the year up 12.05%, while the widely-quoted S&P 500 index of large company stocks was up 3.25% in the fourth quarter, finishing up 9.54% for calendar 2016.

The Wilshire U.S. Mid-Cap index gained 5.31% in the final quarter, finishing the year with a gain of 17.22%. The Russell Midcap Index gained 3.21% in the fourth quarter, and was up 13.80% in calendar 2016.

This was a year to remember for investors in small company stocks. As measured by the Wilshire U.S. Small-Cap index, investors posted an 8.30% gain over the last three months of the year, for a total return of 22.41% over the entire 12 months. The comparable Russell 2000 Small-Cap Index finished the year up 21.31%, while the technology-heavy Nasdaq Composite Index rose 1.34% in the fourth quarter, to finish the year up 7.50%.

International investments contributed a slight decline to overall portfolio returns. The broad-based EAFE index of companies in developed foreign economies lost 1.04% in the fourth quarter of the year, finishing the year down 1.88% in dollar terms (I expect these stocks to carry the winning torch any day now). In aggregate, European stocks lost 3.39% for the year, while EAFE’s Far East Index gained just 0.14%. Emerging markets stocks of less developed countries, as represented by the EAFE EM index, gained 8.58% for the year.

Looking over the other investment categories, real estate investments, as measured by the Wilshire U.S. REIT index, lost 2.28% during the year’s final quarter, but managed to finish up 7.24% for calendar 2016.

Last year, investors were wondering why they owned commodities in their portfolios, when their statements showed that the index delivered a whopping 32.86% loss. This year, they may be wondering why they weren’t more committed to the asset class, as the S&P GSCI index gained 27.77%, fueled in part by a 45.03% rise in the S&P crude oil index. Gold prices shot up 8.63% for the year and silver gained 15.84%.

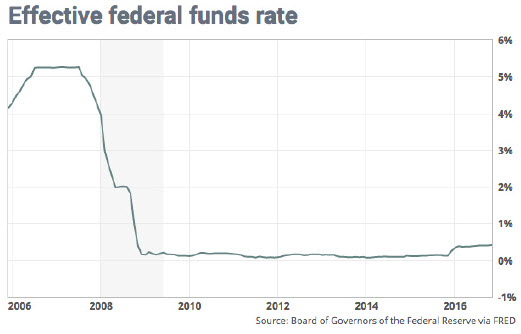

In the bond markets, it’s possible that the decades-long bull market—which basically means declining interest rates—has ended, and the fixed-income world is experiencing rate rises. But despite the nudge by the Federal Reserve Board, the moves have not exactly been dramatic. Over the past year, rates on 10-year Treasury bonds have risen from 2.25% to 2.44%, while 30-year government bond yields have risen from 3.00% to 3.07%. According to Barclay’s Bank indices, U.S. liquid corporate bonds with a 1-5 year maturity have seen yields rise incrementally from 2.4% to 2.8% on average. Despite the many cries and declarations that the 30 year bull market in bonds is over, rest assured that bonds won't go down without a fight (winning streaks that last so long never die that quickly).

As always, there were many unpredictable anomalies in the investment world. In the international markets, anyone lucky enough to have speculated on the Brazilian Bovespa index—comparable to the U.S. S&P 500—would have reaped a gain of 68.9% this year, despite all the headline drama around the Zika virus and political uncertainties that were reported on during the Olympic games. Russian stocks were up 51% for the year, despite the recent sanctions from the U.S. government and the lingering international sanctions related to the invasion of the Crimean peninsula.

As is my obligation as a financial planner, I have to point out that while you may not have realized anywhere near the kinds of returns outlined above for the year, having a diversified and perhaps hedged portfolio means that you never have enough of the stuff that went up and too much of the stuff that came down or underperformed. Risk management of any kind during this bull market (read: diversification) tends to blunt returns during the good times, but is a welcome friend when the markets turn against us. Since no one knows when this is, you have to stick to your investment approach through thick and thin (you do have an investment approach, don't you? We're available to help you craft an investment approach if you need us).

What’s going to happen in 2017? Short-term market traders seem to be expecting a robust economic stimulus combined with lower taxes and deregulatory policies that would boost the short-term profits of American corporations. But it is helpful to remember that we are entering the ninth year of economic expansion, making this the fourth longest since 1900. In addition, growth has not exactly been robust; the U.S. GDP has averaged just 2.1% yearly increases since the Great Recession, making this the most sluggish of all post-World War II expansions.

Slow but steady has not been a terrible formula for workers or stock investors. The unemployment rate has slowly ticked down from a post-recession peak of 10% to less than 5% currently. U.S. stock indices are posting record highs with double-digit gains, and that Dow 20,000 level, while essentially meaningless, is still catching a lot of attention.

It’s clear that the new President-elect wants to accelerate America’s economic growth, but the policy prescription has not always been clear. Will we rip up longstanding trade agreements, cut back on immigration quotas and deport millions of workers who crossed the border without a visa? Will there be a wall built between the U.S. and Mexico? Will the government pay for huge infrastructure projects, at the same time reducing taxes and thus raising the national debt? Will Congress raise the debt ceiling without protest if that happens? Will the Fed raise rates more aggressively in the coming year, or cooperate with the President-elect in his efforts to drive the economy into a faster lane?

At the same time, there are many unknowns around the globe. China’s economic growth has stalled for the second consecutive year, and you will soon be reading about a banking crisis in Italy that could force the country to leave the Eurozone—potentially a much bigger blow to European economic unity than Brexit or a still-possible Greek exit. Russian hackers may have ushered in an era of unfettered global intrusions into our Internet infrastructure, and there will surely be a continuation of ISIS-sponsored terrorism in Europe and elsewhere.

Every year of this longstanding bull market, we have to look over our shoulders and wonder when and how it will end. With the January downturn and so much uncertainty at this time last year, nobody could have predicted double-digit returns on U.S. stocks at year-end. This year could bring more of the same, or it could fulfill the dire predictions many have made during the election cycle, including both Democrats and Republicans who believe the country is in worse shape than the numbers would indicate. Just remember that bull markets rarely die of old age; instead, they die from excessive enthusiasm and ebullience. This bull market is anything but ebullient.

What we have learned over the past few years is that the markets have a way of surprising us, and that trying to time the market, and get out in anticipation of a downturn, is a loser’s game. At the county fair or amusement park, when we get on the roller coaster, we don’t bail out and jump over the side at some scary point on the track; we hang on for the remainder of the ride. The history of the markets has been a general upward trend that benefits long-term investors, and looking out over the long-term, that—and a few hard bumps along the way--is probably the best outcome to expect.

This is not to say that you should commit 100% of your capital to the market or stay all in at all times. It never hurts to take a few chips off the table when things are going well so that you have some dry powder to deploy when those hard bumps come along. Rebalancing into underperforming investment classes at least once or twice a year is always a good idea as well.

If you would like to review your current investment portfolio or discuss any other financial planning matters, please don’t hesitate to contact us or visit our website at http://www.ydfs.com. We are a fee-only fiduciary financial planning firm that always puts your interests first. If you are not a client yet, an initial consultation is complimentary and there is never any pressure or hidden sales pitch. We start with a specific assessment of your personal situation. There is no rush and no cookie-cutter approach. Each client is different, and so is your financial plan and investment objectives.

You can interact with Sam TheMoneyGeek and read his latest musings on Twitter at http://twitter.com/themoneygeek

Sources:

Wilshire index data: http://www.wilshire.com/Indexes/calculator/

Russell index data: http://www.russell.com/indexes/data/daily_total_returns_us.asp

S&P index data: http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf--p-us-l--

Nasdaq index data: http://quotes.morningstar.com/indexquote/quote.html?t=COMP

http://www.nasdaq.com/markets/indices/nasdaq-total-returns.aspx

International indices: https://www.msci.com/end-of-day-data-search

Commodities index data: http://us.spindices.com/index-family/commodities/sp-gsci

Treasury market rates: http://www.bloomberg.com/markets/rates-bonds/government-bonds/us/

Aggregate corporate bond rates: https://index.barcap.com/Benchmark_Indices/Aggregate/Bond_Indices

Aggregate corporate bond rates: http://www.bloomberg.com/markets/rates-bonds/corporate-bonds/

Muni rates: https://indices.barcap.com/show?url=Benchmark_Indices/Aggregate/Bond_Indices

http://www.wsj.com/articles/chinas-stock-market-still-a-draw-after-tumultuous-year-1451303164

http://www.marketwatch.com/story/these-are-the-bestand-worstperforming-assets-of-2016-2016-12-30?link=sfmw_tw

http://www.theworldin.com/article/10632/unsettling-year-markets

http://www.forbes.com/sites/maggiemcgrath/2016/12/30/markets-end-last-trading-day-of-2016-in-red-but-post-gains-for-the-year/#7db846fd7c07

The MoneyGeek thanks guest writer Bob Veres for his contribution to this post

Wednesday, March 15, 2017 at 12:35PM

Wednesday, March 15, 2017 at 12:35PM